Travel for and during work

The Executive Board decides to impose an immediate (effective 10 July 2024) ban on international travel from the first flow of funds.

The ban on international travel from first flow of funds applies to international business trips or trips related to employment abroad. It does not apply to international commuting (e.g. that of frontier workers living in Germany).

When you are required to travel in or outside the Netherlands because of your position, this qualifies as a business trip. Commuter traffic and travel on campus is not considered business trips by the UT. Temporary employment elsewhere in the Netherlands or abroad does not qualify as a business trip.

Authorisation

A business trip is undertaken in consultation with the budget holder. If your business trip has been approved, the UT will pay for the necessary costs for travel and accommodation. More information on the conditions to be met is available in the Regulations on declaring expenses University of Twente. Costs are declared via Unit4, see the explanation below under 'practical matters travel expenses'.

Domestic business travel

Public transport is used for domestic business travel. For this travel, by train bus, tram or metro, you may use a NS Business Card of the UT.

- More info on NS business card

The NS-BC is a public transportation (OV) -chip card UT employees can use for business travel by public transport (metro, train, bus, etc.) within the Netherlands and in some cases commuter travel.

- Travel by check in/out

- All forms of public transport (tram, metro, train and bus) and all carriers in the Netherlands are connected to the card

- Use of OV bike

- Commuter travel by public transport provided by the UT is integrated into the NS Business Card (NS-BC)

- International train travel using NS-BC portal Mijn NS Zakelijk

- No discount percentage on the standard card (discount via seasonal tickets can be (de)activated per month)

- Valid for 5 years

Each unit (faculty, department or service centre) made a choice to provide either personal cards or use department cards.

- See all units and their type of cards

Personal NS-BC

Department NS-BC:

Library & Archive (LISA)

General Affairs (GA)

Engineering Technology (ET)

Campus & Facility Management (CFM)

Electrical Engineering, Mathematics and Computer Science (EEMCS)

Finance

Geo-information Science and Earth Observation (ITC)

Marketing and Communications (MC)

Behavioural, Management and Social sciences (BMS)

Centre for Educational Support (CES)

Science and Technology (TNW)

Human Resources (HR)

Strategy & Policy (SP)

For online bookings with a personal card, go to "How do you log in to Mijn NS Zakelijk?"

Before traveling with the business card, read the terms of use:

- Terms of use NS Business Card UT

GENERAL

For domestic business trips by public transport, staff members will make use of the NS Business Card. It will not be possible to claim expenses for other tickets in case of a domestic business trip.

There are two types of NS Business Card: the personal card and the department card.

The personal card is issued in the name of/is administered by the staff member whose name the card is issued. This person may only use the NS-BC. The unit (faculty, department) determines to whom a personal card will be made available.

The department card is issued in the name of/is administered by a unit. Staff members who do not receive a personal card, make use of a department card provided by the unit for domestic business trips.

By receiving a personal card or by signing the register of a department card, the staff member agrees to the conditions for using the NS-BC.

USE

- As a rule, the NS-BC can only be used for UT domestic business trips by public transport. Use of the card for other purposes is only allowed in the situation described under 2.

- A personal NS-BC to which a public transport seasonal ticket, purchased by the UT, has been linked, may be used for commuting by the staff member. Use of the card for other, personal purposes is only allowed if and in so far as the seasonal ticket linked to the NS-BC allows for this without any further costs being incurred.

- The staff member may only use the NS-BC as a ticket for public transport trips and store a bicycle in an NS bicycle shed at the railway station and to hire an OV-bike. With the permission of the superior prior to the business trip, the staff member is allowed to also use the NS-BC for an (OV-)taxi ride from the station to their destination and to use the Q-park P+R parks. The use of any other services of the NS-BC is not permitted.

- The staff member is not allowed to lend out the NS-BC to third parties or to have third parties use the card.

- If used correctly, the staff member will not be charged any costs for using the NS-BC.

- If the NS charges the UT an adjusted rate because a staff member has not used the NS-BC correctly, the unit may recover the costs associated with this incorrect use from the staff member concerned.

- If a staff member makes improper use of the NS-BC, the UT will settle all costs associated with this improper use with the payments to be made to the staff member concerned (salary, allowances, reimbursements and such).

- In the event of improper use of the NS-BC, the UT may take disciplinary measures.

Theft, loss or damage

- The staff member shall immediately report the theft or loss of the NS Business Card to the contact person of the unit (see 'help and contact' below).

- If a staff member does not immediately report the theft or loss of the card, the unit may recover the costs associated with the theft or loss from the staff member concerned.

- Replacement of the personal NS Business Card in case of theft, loss or damage, runs via the contact person of the unit.

Handing in the NS Business Card

- The staff member to whom a personal NS-BC has been made available shall hand in the card to the contact person of the unit upon the termination of the employment, no later than on the last working day.

- The staff member who for a business trip has made use of the department card shall hand in the NS-BC as soon as possible after return to the secretary’s office where the card was collected.

- The staff member to whom a personal NS Business Card has been made available but who does not wish to make (continued) use of the card, can hand in the card with the contact person of the unit (see 'help and contact' below).

- In case of improper use of the NS-BC, it will be withdrawn.

- If the staff member hands in the personal NS-BC or if it is withdrawn, they will be given proof of submission/return.

Contact

For each unit a contact is appointed. This person can provide you with further information about how the cards are distributed, where you can find the card manager for your department, or what Projectnumber is connected to which card. In case of malfunction, theft or loss, you need to report to this person.

For questions about traveling or using the NS Business Card, you can contact NS customer services; by phone 030 - 300 11 11, email nszakelijk@ns.nl.

- Show contact per unit

Unit / department

Name contact

Back up

LISA (Library and Archive)

ET (Engineering Technology)

EEMCS (Electrical Engineering, Mathematics and Computer Science)

CFM (Facility Service Centre)

BMS (behavioural sciences)

HR (Human Resources)

ITC (Geo-information Science and Earth Observation)

MC (Marketing and Communications)

S&B (Strategy & Policy)

ST (Science and Technology)

CES (Centre for Educational Support)

In case of prolonged absence of the contact, you should report to Secretariaat HR. This also applies to UT employees who aren’t employed by any of the above mentioned units.

Personal NS-BC

- Create "mijn NS zakelijk" -account

Your personal NS-BC is automatically activated and can be used in train, bus, tram, metro by checking in and out. If you want to change the workorder-number for a trip, switch classes, view your trips, etc. you need to create a Mijn NS Zakelijk account. A more detailed instruction can be downloaded below;

The NS Business Card is for business travel by public transport only (and in some cases commuter travel). The NS-BC is NOT to be used for personal purposes.*

Information needed at first log-in

- NS-BC card number. The card number is visible on the NS-BC (16 digits)

- accompanying PIN code (default last 4 digits of the card number)

- Go to www.ns.nl/mijnnszakelijk

On the right side of the screen right of the picture of the new card, click here. - Fill out your @utwente.nl e-mail address and confirm. You will now receive an e-mail with a link to activate Mijn NS Zakelijk.

- After confirming you address and creating an account, you will receive an email which provides an email through which you have to activate your account. In this email you have to click on hier or copy the URL in the address bar of your browser.

- After clicking the link in the confirmation email, your browser will open a webpage. On this page, you need to enter a password (twice, to make sure you entered it correctly) and click opslaan (save/submit).

*A personal NS Business Card to which a public transport seasonal ticket, purchased by the UT, has been linked, may be used for commuting. Use of the card for other, personal purposes is only allowed if and in so far as the seasonal ticket linked to the NS Business Card allows for this without any further costs being incurred. If you are entitled to a seasonal ticket provided by the UT, you have been notified by HR.

- How to use your personal NS business card

The NS Business Card is for business travel by public transport only (and in some cases, commuter travel). The NS-BC is NOT to be used for personal purposes.*

Before travelling with the business card, read the terms of use:

- Terms of use NS Business Card UT

GENERAL

For domestic business trips by public transport, staff members will make use of the NS. Businesscard. It will not be possible to claim expenses for other tickets in case of a domestic business trip.

There are two types of NS. Businesscard: the personal card and the department card.

The personal card is issued in the name of/is administered by the staff member in whose name the card is issued. The NS. Business Card may only be used by this person. The unit (faculty, department) determines to whom a personal card will be made available.

The department card is issued in the name of/is administered by a unit. Staff members who do not receive a personal card, make use of a department card provided by the unit for domestic business trips.

By receiving a personal card or by signing the register of a department card, the staff member agrees to the conditions for using the NS. Business Card.

USE

- As a rule, the NS. Business Card can only be used for UT domestic business trips by public transport. Use of the card for other purposes is only allowed in the situation described under 2.

- A personal NS. Business Card to which a public transport seasonal ticket, purchased by the UT, has been linked, may be used for commuting by the staff member. Use of the card for other, personal purposes is only allowed if and in so far as the seasonal ticket linked to the NS. Business Card allows for this without any further costs being incurred.

- The staff member may only use the NS. Business Card as a ticket for trips by public transport and for storing a bicycle in an NS. bicycle shed at the railway station. If the superior has given permission prior to the business trip, the staff member is allowed to use the NS. Business Card also for a (train)taxi ride from the station to his or her destination and for using the Q-Park P+R car parks. The use of any other services of the NS. Business Card is not allowed.

- The staff member is not allowed to lend out the NS. Business Card to third parties or to have third parties use the NS. Business Card.

- If used correctly, the staff member will not be charged any costs for using the NS. Business Card.

- If the NS charges the UT an adjusted rate because a staff member has not used the NS. Business Card correctly, the unit may recover the costs associated with this incorrect use from the staff member concerned.

- If a staff member makes improper use of the NS. Business Card, the UT will settle all costs associated with this improper use with the payments to be made to the staff member concerned (salary, allowances, reimbursements and such).

- Improper use of the NS. Business Card is considered as neglect of duty in the sense of the Disciplinary Measures Regulation UT.

Theft, loss or damage

- The staff member shall immediately report the theft or loss of the NS Business Card to the contact person of the unit (see 'help and contact' below).

- If a staff member does not immediately report the theft or loss of the NS Business Card, the unit may recover the costs associated with the theft or loss from the staff member concerned.

- Replacement of the personal NS Business Card in case of theft, loss or damage, runs via the contact person of the unit.

Handing in the NS. Business Card

- The staff member to whom a personal NS. Business Card has been made available, shall hand in the Card to the contact person of the unit upon termination of the employment, no later than on the last working day.

- The staff member who for a business trip has made use of the department card, shall hand in the NS. Business Card as soon as possible after return to the secretary’s office where the Card was collected.

- The staff member to whom a personal NS. Business Card has been made available but who does not wish to make (continued) use of the Card, can hand in the card with the contact person of the unit (see 'help and contact' below).

- In case of improper use of the NS. Business Card, it will be withdrawn.

- If the staff member hands in the personal NS. Business Card of if it is withdrawn, he or she will be given proof of submission/return

Travel via check-in and check-out

You can travel with your NS-BC by bus, tram, train, and metro by simply using "check in, check out.”

Travel with a discount

In general, your NS-BC comes without a season ticket or discount. For each card, your contact person can (de-)activate a season ticket. You can check if any discount is activated in the Mijn NS Zakelijk portal. If you foresee an increase in your business travel, you can ask the contact person for your department to activate a season ticket.

- Mijn NS Zakelijk portal

You can view and alter your travel details in the Mijn NS Zakelijk portal.

To get access you have to create an account at the login page. If you forgot your password you can also request a new one at this page.

If you have trouble logging onto the portal or you lost all your login details, you should contact NS Customer service, phone +31 (0) 30 3001111, email nszakelijk@ns.nl

- More information

If you forgot your card, you should check the FAQ to find out what to do. If you have any questions about the NS-BC or what to do when your card is lost or stolen, you should contact the NS-BC contact within your department.

More information on travelling with your NS-BC: www.ns.nl/en/business. If you have any questions, you can contact NS Customer service by phone 030 300 11 11 or email nszakelijk@ns.nl.

- Taxirit

Your taxi trip can be booked online by logging in via Mijn NS Zakelijk. You can also book by telephone no later than half an hour beforehand via 0900 204 2000 (€0.10 per minute). Before booking, make sure you have permission to take a taxi.

The taxi doesn’t wait for more than 5 minutes. You need to book at least 30 minutes in advance. You can change or cancell up to 30 minutes before departure. If you want to travel at night between 1.00 and 7.00, you need to book at least 24 hours in advance.

- Additional Services

Allowed*:

Not Allowed:

- Train

- NS Bicycle parking

- Bus, tram, metro

- Bicycle rental

Free with NS-BC:

- NS Hispeed Lounge

- Taxi (only with permission)Q-park (only with permission), park&ride

- Greenwheels

* Only when used for business travel

- Bicycle parking

With your card you can park your bike at 36 NS Bicycle parkings. After you have had your NS-Business Card scanned in and a barcode has been affixed to your bicycle, you can put it in the supervised storage area.

NS Stations with parking facilities accessible with your NS-BC

Alkmaar, Alphen a/d Rijn, Amersfoort, Amsterdam Centraal (2 stallingen), Arnhem, Assen, Breda, Delft, Den Haag Centraal, Den Haag HS, Dordrecht, Ede Wageningen Zuidzijde, Eindhoven (2 stallingen), Gouda Noordzijde, Haarlem, 's-Hertogenbosch, Hilversum, Hoorn, Leeuwarden, Leiden (2 stallingen), Maastricht, Meppel, Nijmegen, Roermond, Rotterdam Centraal (2 stallingen), Tilburg, Utrecht (Oost- en Westzijde), Venlo, Weesp, Woerden, Zwolle.

Pilot parking at Station Enschede

In Enschede it should be possible to park and retrieve your bike using your NS-BC during opening hours. More information is on the NS Bicycle website.

- NS Hispeed lounge

You have free access to the lounges at Amsterdam Centraal, Rotterdam Centraal, Schiphol and Breda stations.

- Q-Park

When you hold your NS-Business Card Dal up to the card reader as you drive in or out, the barrier will open. In Gouda and Sittard, you receive a ticket that you can pay for at the car park ticket machine using your NS-Business Card. Note that you are only allowed to use these services if you have permission from your manager.

- Taxi

If you want to use the taxi services you this has to be pre-approved by your manager.

Booking a taxi from the station using your NS-Business Card is very easy. There is no need for you any longer to pay it first, keep the receipts and then declare the expenses. Your taxi trip can be booked online by logging in using your card number and PIN code via Mijn NS Zakelijk. If you book a taxi trip using a departmental card, please also state your name in the comments field. You can also book by telephone no later than half an hour beforehand via 0900 204 2000 (€0.10 per minute).

Note!

- The taxi will wait for 5 minutes at the agreed upon spot

- A (train)taxi to the station can be booked online or by phone no later than half an hour beforehand. A taxi at the station can only be booked through the taxi stand on the spot.

- You need permission from your manager to use the taxi service.

- Greenwheels car service

GREENWHEELS CAR SERVICE

It is NOT ALLOWED to use the Greenwheels car service. Munsterhuis is the preferred car rental for UT.

- OV Bicycle

It is permitted to use the OV bicycle for business travel.

Department NS-BC

- Instruction card administration

In the administrator section in your 'Mijn NS Zakelijk' account you can manage view transactions, view and change card details, and book trips.

SHORT SUMMARY

- Before their business travel, employees pick up the card at the administrator.

- The administrator makes sure the employee fills out the register before they receive a card.

- This information includes workorder number, travel details, date of pick up, and the employees signature

- After the journey the administrator collects the card and signs the register upon receiving the card

- Afterwards the administrator checks if the standard workorder number needs to be changed and an alternative workorder number needs to be added as kenmerk

- Who can create an administrator account for the department card?

In most cases the administration for the department card will fall to the secretariat or office. Department cards are added to the administrator section of your Mijn NS Zakelijk account by the UT administrator/contact.

- Creating a mijn ns zakelijk account (once-only)

In case you don’t have a Mijn NS Zakelijk account, you can create one by going to www.ns.nl/mijnnszakelijk (and following the instructions on screen). The UT contact/administrator can add the department cards to your account, under the administrator section.

MIJN NS ZAKELIJK ACCOUNT

- Add a characteristic (kenmerk) to a trip

When an workorder number (NS calls this “kenmerk”) needs to be changed, go to kenmerk aan reis toevoegen in your account. This gives you an overview of all transactions (“transacties”). Two days after a trip it is possible to view a transaction and alter an workorder number.

The next invoice (.csv) will show all characteristics. There is also an option to add a label (either personal, commuter or business) as a characteristic to a transaction. For a department card this is not necessary as it will always be business travel.

On your home screen there are also buttons for Taxi, Greenwheels and Fyra. These are options employees aren’t allowed to use (apart from the taxi services, permitted after approval upfront).

- Alter workorder numbers and transaction overview

After a trip you have the option to change the workorder number via the transaction overview in Mijn NS Zakelijk. To do this, go to Kenmerk aan reis toevoegen on you home screen. Select a card to view all transactions made on the card. Note: for train trips it takes two days for transactions to be added to the overview. To add an workorder number, go to a specific transaction and select kenmerk toevoegen , enter the new workorder number (only numbers) and save (opslaan).

MORE INFORMATION

If you encounter problems with creating an account or booking a trip, you can contact NS Customer Service directly: phone +31(0) 30-300 11 11 or e-mail nszakelijk@ns.nl.

You can also contact your unit’s contact person or the UT contact.

- Department card: How to

The Department Card is for business travel by public transport only. The department card is NOT to be used for personal purpose and/or commuter travel.

Before traveling with the business card, read the terms of use:

- Terms of use NS Business Card UT

GENERAL

For domestic business trips by public transport, staff members will make use of the NS. Businesscard. It will not be possible to claim expenses for other tickets in case of a domestic business trip.

There are two types of NS. Businesscard: the personal card and the department card.

The personal card is issued in the name of/is administered by the staff member in whose name the card is issued. The NS. Business Card may only be used by this person. The unit (faculty, department) determines to whom a personal card will be made available.

The department card is issued in the name of/is administered by a unit. Staff members who do not receive a personal card, make use of a department card provided by the unit for domestic business trips.

By receiving a personal card or by signing the register of a department card, the staff member agrees to the conditions for using the NS. Business Card.

USE

- As a rule, the NS. Business Card can only be used for UT domestic business trips by public transport. Use of the card for other purposes is only allowed in the situation described under 2.

- A personal NS. Business Card to which a public transport seasonal ticket, purchased by the UT, has been linked, may be used for commuting by the staff member. Use of the card for other, personal purposes is only allowed if and in so far as the seasonal ticket linked to the NS. Business Card allows for this without any further costs being incurred.

- The staff member may only use the NS. Business Card as a ticket for trips by public transport and for storing a bicycle in an NS. bicycle shed at the railway station. If the superior has given permission prior to the business trip, the staff member is allowed to use the NS. Business Card also for a (train)taxi ride from the station to his or her destination and for using the Q-Park P+R car parks. The use of any other services of the NS. Business Card is not allowed.

- The staff member is not allowed to lend out the NS. Business Card to third parties or to have third parties use the NS. Business Card.

- If used correctly, the staff member will not be charged any costs for using the NS. Business Card.

- If the NS charges the UT an adjusted rate because a staff member has not used the NS. Business Card correctly, the unit may recover the costs associated with this incorrect use from the staff member concerned.

- If a staff member makes improper use of the NS. Business Card, the UT will settle all costs associated with this improper use with the payments to be made to the staff member concerned (salary, allowances, reimbursements and such).

- Improper use of the NS. Business Card is considered as neglect of duty in the sense of the Disciplinary Measures Regulation UT.

Theft, loss or damage

- The staff member shall immediately report the theft or loss of the NS Business Card to the contact person of the unit (see 'help and contact' below).

- If a staff member does not immediately report the theft or loss of the NS Business Card, the unit may recover the costs associated with the theft or loss from the staff member concerned.

- Replacement of the personal NS Business Card in case of theft, loss or damage, runs via the contact person of the unit.

Handing in the NS. Business Card

- The staff member to whom a personal NS. Business Card has been made available, shall hand in the Card to the contact person of the unit upon termination of the employment, no later than on the last working day.

- The staff member who for a business trip has made use of the department card, shall hand in the NS. Business Card as soon as possible after return to the secretary’s office where the Card was collected.

- The staff member to whom a personal NS. Business Card has been made available but who does not wish to make (continued) use of the Card, can hand in the card with the contact person of the unit (see 'help and contact' below).

- In case of improper use of the NS. Business Card, it will be withdrawn.

- If the staff member hands in the personal NS. Business Card of if it is withdrawn, he or she will be given proof of submission/return

- Pick up your business card

Go to your card administrator at least one day before you have to travel by train (usually your office/ secretariat ). If you don’t know where you can to pick up a card, go to the contact of your unit.

Fill out and sign the register to get a department card. Make sure you enter the right workorder number. After your trip hand the card back to the card administrator as soon as possible.

- Check in/out

The NS-BC can be used in trains, busses, metro and trams by checking in and out.

Note

- Make sure to always check in and out. If you forgot to check out, go back to a train station (on the same day) and check out.

- Always inform your card administrator in case the workorder number needs to be altered. When needed the card administrator has the option to change the number afterwards.

- More information / contact

More information on how to travel with the NS-BC can be found on the NS website.

If your card has a defect, is stolen or you need a new one? Contact the contact your unit’s contact person.

For questions on how to travel with the NS-BC, you need to contact the NS directly: phone +31 (0)30 300 11 11 or e-mail: nszakelijk@ns.nl.

For questions on the distribution or in case of theft/loss contact your unit’s contact person.

- Additional Services

Allowed*:

Not Allowed:

- Train

- NS Bicycle parking

- Bus, tram, metro

- Bicycle rental

Free with NS-BC:

- NS Hispeed Lounge

- Taxi (only with permission)

- Q-park (only with permission), park&ride

- Greenwheels

* Only when used for business travel

- Bicycle parking

With your card you can park your bike at 36 NS Bicycle parkings. After you have had your NS-Business Card scanned in and a barcode has been affixed to your bicycle, you can put it in the supervised storage area.

NS Stations with parking facilities accessible with your NS-BC

Alkmaar, Alphen a/d Rijn, Amersfoort, Amsterdam Centraal (2 stallingen), Arnhem, Assen, Breda, Delft, Den Haag Centraal, Den Haag HS, Dordrecht, Ede Wageningen Zuidzijde, Eindhoven (2 stallingen), Gouda Noordzijde, Haarlem, 's-Hertogenbosch, Hilversum, Hoorn, Leeuwarden, Leiden (2 stallingen), Maastricht, Meppel, Nijmegen, Roermond, Rotterdam Centraal (2 stallingen), Tilburg, Utrecht (Oost- en Westzijde), Venlo, Weesp, Woerden, Zwolle.

- Pilot parking at Station Enschede

In Enschede it should be possible to park and retrieve your bike using your NS-BC during opening hours.

More information the NS Bicycle Website.

- NS Hispeed lounge

NS HISPEED LOUNGE

You have free access to the lounges at Amsterdam Centraal, Rotterdam Centraal, Schiphol and Breda stations.

www.nsinternational.com/nl/stations/nsinternational-lounge - Q-Park

When you hold your NS-Business Card Dal up to the card reader as you drive in or out, the barrier will open. In Gouda and Sittard, you receive a ticket that you can pay for at the car park ticket machine using your NS-Business Card. Note that you are only allowed to use these services if you have permission from your manager.

- Taxi

If you want to use the taxi services you this has to be pre-approved by your manager.

Booking a taxi from the station using your NS-Business Card is very easy. There is no need for you any longer to pay it first, keep the receipts and then declare the expenses. Your taxi trip can be booked online by logging in using your card number and PIN code via Mijn NS Zakelijk. If you book a taxi trip using a departmental card, please also state your name in the comments field. You can also book by telephone no later than half an hour beforehand via 0900 204 2000 (€0.10 per minute).

Note

- The taxi will wait for 5 minutes at the agreed-upon spot

- A (train)taxi to the station can be booked online or by phone no later than half an hour beforehand. A taxi at the station can only be booked through the taxi stand on the spot.

- You need permission from your manager to use the taxi service.

- Greenwheels car service

It is NOT ALLOWED to use the Greenwheels car service. Munsterhuis is the preferred car rental for the UT.

- OV Bicycle

It is permitted to use the OV bicycle for business travel.

Help

- FAQ

GENERAL

- Who is eligible for an NS Business Card

Your department or unit (faculty, department, service centre) has made a selection based on past business travel patterns. It is possible that your department or unit opts to use personalized cards, or (non personal) department cards exclusively. Employees who are not issued with a personal NS Business Card can use the department card, available through the secretarys office or card administrator, for their business train travels. Employees who are entitled to commuter travel by public transport issued by the UT will be provided with a personal business card (with season ticket).

This answers my question.Thank you for your feedback - How long is the NS Business Card valid for?

The current NS Business Card (1 april 2014) is valid for 5 years. You will receive notification about the next stage before your card expires.

This answers my question.Thank you for your feedback - When should I start using the NS Business Card?

As of 1 March 2012, all UT employees can use either their personal or department NS Business Card for business travel by public transport within the Netherlands. From 1 March 2012, it will no longer be possible to claim expenses for other train tickets/cards used for business travel.

This answers my question.Thank you for your feedback - How can I change the workorder number?

Each card has been linked to a specific workorder number. All travel costs are charged to this workorder number. If you travel using check in/out, you consult your travel history afterward (usually visible after 2 days) with Mijn NS Zakelijk. Go to "Kenmerk (aan reis) toevoegen" and specify the preferred workorder number in the annotation field. If an workorder number has to be changed permanently (because you switched projects/departments), you should contact your unit's contact person.

Note. Make sure to change the workorder number in the same calendar month the trip occurred. Enter only the preferred workorder number and no additional text (and no hypen). Any additional text will make it illegible for the SAP programme to read.

This answers my question.Thank you for your feedback - Where can I find an overview of my travel details?

For an overview of your travel details of a personal card, you can create a personal Mijn NS Zakelijk account. Travel data will be visible as of two days after journey. For an overview of travel details for a department card, you can ask your card holder to access the account for the department card.

This answers my question.Thank you for your feedback - How are the travel costs settled?

A monthly invoice is sent to the University. Your NS Business Card contains a personal reference number (workorder number), which automatically charges the costs to your unit.

This answers my question.Thank you for your feedback - When will I get a NS Business Card?

NS Business Cards will be distributed mid-March. Department cards will be available through secretary offices or through your unit's contact.

New employees or employees who didn't receive contract extention before 15 January (termination 1 April), but will after this date, can expect their card in April/May, and should use a department card in the mean time.

This answers my question.Thank you for your feedback - Where can I use the NS Business Card?

The NS Business Card can only be used for business travel by pubic transport within the Netherlands and in some cases for commuter travel (HR has informed you beforehand if you are entitled to commuter travel), NS Bicycle parking, taxi services and Q-park (with the condition that your supervisor gave persmission beforehand). The NS Business Card cannot be used for other products or services such as the OV bike or Greenwheels.

This answers my question.Thank you for your feedback - Where can I get more information?

You can contact your unit's contact (see and call or email the NS customer services 030 300 11 11 (8:30 a.m. - 5 p.m.) / nszakelijk@ns.nl

This answers my question.Thank you for your feedback - Which workorder number is linked to which card?

The NS contact of your unit has access to a list with workorder numbers and related card numbers.

This answers my question.Thank you for your feedback - Can I still claim expenses for railway passes other than the NS Business Card?

No. It will no longer be possible to claim expenses for other railway tickets. This applies to both paper tickets and private travel passes.

This answers my question.Thank you for your feedback

ACTIVATE

- Can I immediately start using the NS Business Card?

All cards are activeted for check-in/out upon receipt.

You can create a personal account by going to Mijn NS Zakelijk.

This answers my question.Thank you for your feedback - How do I activate my NS Business card or create a Mijn NS Zakelijk account?

All cards are activeted for check-in/out upon receipt.

You can create a personal account by going to Mijn NS Zakelijk.

This answers my question.Thank you for your feedback - How do I change my PIN?

For online bookings or bookings by phone, you need a pincode or PIN. The default code is the same as the last 4 digits of the 16-digit card number. When you create you MijnNS Zakelijk account you will need to change this code. To change the code, you need a MijnNS Zakelijk account. Go to MijnNS Zakelijk and create an account. For department cards your card holder usually has the pin code.

This answers my question.Thank you for your feedback

CARD

- What should I do if my NS Business Card is lost or stolen?

Please report theft or loss of your NS Business Card immediately to the NS contact of your unit. If you aren't able to contact this person, try another NS contact on the list.

This answers my question.Thank you for your feedback - What if my contract gets terminated?

Return your card to the NS contact of your unit. Do this before your last day.

This answers my question.Thank you for your feedback - What if I don't want a personal card?

When you don't want access to a personal card, because of the risk of loss etc., you may hand in the card at your units contact. Note. When handed in, the card will be blocked for further use.

This answers my question.Thank you for your feedback - What should I do, in case my card has a defect?

Report this to the contact of your unit and return your card. A new card will be ordered.

This answers my question.Thank you for your feedback - How long is the NS Business Card valid for?

The NS Business Card is valid for 5 years.

This answers my question.Thank you for your feedback - Does using the NS Business Card cost me anything?

No. When you use it responsibly, using the card is free and there are no additional costs. However you should use it for business train travel only.

This answers my question.Thank you for your feedback - Can I put money on my card, like a regular OV-chip card?

No. The NS terms for the Business card, do not allow this. You can however use your card for all forms of public transport e.g. metro, busses, trams.

This answers my question.Thank you for your feedback

TRAVELING

- What are the arrangements for computer travel?

For commuter travel, employees use season tickets or a travel subscription. As of 2014 these tickets (when issued by HR/UT) are integrated on the NS-BC.

This answers my question.Thank you for your feedback - Can I start using the NS Business Card immediately?

All cards are activeted for check-in/out upon receipt. You can use it immediately in bus, tram, metro and train.

This answers my question.Thank you for your feedback - Which train trips should be booked in advance?

Is is no longer necessary to book trips in advance. You should use the check-in / out option at the station or in the bus/tram.

This answers my question.Thank you for your feedback - Do I need to check in and out when I Transfer to a different train?

If you transfer to a different NS train, you have to check out if you change carriers. If you transfer to another carrier, you will need to check out with the one carrier and check in and out again with the next for the remainder of your trip. For example, if you are travelling from Hengelo to Arnhem via Zutphen. You need to will need to check in with Syntus at Hengelo station. In Zutphen you need to check out with Syntus first and check in with NS after for the remainder of your trip. In Arnhem you check out for NS.

This answers my question.Thank you for your feedback - Can others travel on my NS Business Card with me?

No, the NS Business Card an only be used by one person at the time. Some department cards however have a discount ticket on them, which allows travel companions to use the 40% "samenreiskorting".

This answers my question.Thank you for your feedback - What class do I travel in?

The NS Business Card is delivered in the class setting as it was initially ordered in. Corresponding the UT travel policy this is 1st class. You are not restricted to this default setting. If you prefer to travel in a different class, you can change your settings at MijnNS Zakelijk.

This answers my question.Thank you for your feedback - Can I also use the NS Business Card for commuter travel or personal travel?

It is not allowed to use the card for personal travel purposes. The NS Business Card is to be used for business travel. Business travel involves an employee travelling outside the place of employment to carry out work activities as assigned by management. If an employee makes improper use of the card, the university is authorized to confiscate the card immediately and deduct the costs from payments owed to the employee. The employee who has made improper use of the card can also be liable to disciplinary measures. A personal NS Business Card to which a public transport seasonal ticket, purchased by the UT, has been linked, may be used for commuting by the staff member. Use of the card for other, personal purposes is only allowed if and in so far as the seasonal ticket linked to the NS Business Card allows for this without any further costs being incurred.

This answers my question.Thank you for your feedback - Can I use the NS Business Card for other products or services?

Yes, but only the NS bicycle parking, Q-park, P+R and taxi services. Before using the taxi services or parking, you need explicit permission from your supervisor. The NS Hispeed Lounges at het Amsterdam, Rotterdam and Schiphol train stations are also free of charge for NS-BC travellers (+1 guest), more info on the lounges NS Hispeed website.

You cannot use the NS-BC for products or services such as the OV bike, Greenwheels and NS scooter.

This answers my question.Thank you for your feedback - Can I get a refund when the train is running late?

Yes, you can request a refund by filling out the form Geld terug bij vertraging. You can get this form at the NS service desk, Kiosk, or ask the Klantenservice 0900-202 11 63 (0,10 euro p.m.). You can also ask for a reimbursement through Mijn NS Zakelijk.

This answers my question.Thank you for your feedback - Can I use my NS Business Card to travel by bus, tram or metro?

Yes, with most carriers for bus, tram and metro it is now possible to use the NS-BC.

This answers my question.Thank you for your feedback - What if I forget to bring my NS Business Card?

Your only option is to purchase a (paper) ticket and contact the contact person of your unit afterwards.

This answers my question.Thank you for your feedback - Is it possible to travel on just one card with a group / with more than one person at the same time?

No. Just like with the regular OV-chip card, it is not possible to use it for travel with more than one person at the time.

This answers my question.Thank you for your feedback

BOOKING IN ADVANCE

- Checking in/out or booking in advance?

The taxi service is the only service that can be booked in advance. Travelling by train, bus, metro or tram takes place by checking in and out.

This answers my question.Thank you for your feedback - How do I change or cancel a booking?

You can change or cancel a booking via the phone 0900-204 2000 (0,10 euro p.m.) or internet Online.

This answers my question.Thank you for your feedback - How do I book a trip online?

Log in on Mijn NS Zakelijk with password and email address (you need to create an account first)

Choose taxi services.

Fill out the information.

Fill in the 'kenmerk' field, if you need to change the workorder number (please only use numbers).

Note. Only taxi services can be booked in advance. Train travel (or metro, bus, tram) takes place by checking in/out.

This answers my question.Thank you for your feedback - How do I book by phone?

Call 0900 - 204 2000 (0,10 euro p.m.).

You need the card number and PIN. Note. Only taxi services need / can be booked in advance.

This answers my question.Thank you for your feedback - Information needed to book in advance?

Card number and PIN.

Workorder number (in case it differs from the default workorder number, to enter under 'kenmerk').

Travel information: departure, destination, etc.

This answers my question.Thank you for your feedback

CHECK IN / CHECK OUT

- Checking in/out or booking in advance?

You can travel by bus, tram, metro and train by checking in and out at the station or in the tram or bus. Booking in advance is only necessary for travel by taxi.

This answers my question.Thank you for your feedback - How to apply for check in/out

Applying for check in / out is not necessary, it is already activated. The cards are ready to use.

This answers my question.Thank you for your feedback - What if I forget to check out?

If you forgot to check out, you can still check out the same day you travelled on. To check in again for a next trip, you will need to wait three minutes. If you do not check out, a correction fee (varying from €10 to €65) will be charged.

This answers my question.Thank you for your feedback - What if I cannot check in?

If a check-in gate or post is not working, you will need to check in at a different gate or post. If none of the check-in points at a station are working, you can buy a paper ticket. For reembursement get in touch with your unit's contact person.

This answers my question.Thank you for your feedback - What if I cannot check out?

If you cannot check out, please report this as soon as possible to the contact of your unit. A correction fee will then be charged to your account. Your contact person can log a request for a refund. If you have a personal card, it is also possible to request a refund through your Mijn NS Zakelijk account.

This answers my question.Thank you for your feedback - Do I need to check in and out when I transfer to a different train?

If you transfer to a different NS train, you do not need to check in or out again. If you transfer to another train carrier, you will need to check out with the NS. For the remainder of your trip will need to check in and out with the next carrier.

This answers my question.Thank you for your feedback - When should I not check in and out?

Always, you can use your card by checking in and out. If you transfer to a different NS train, you do not need to check in and out again. If you transfer onto a different carrier or a different form of public transport, you need to check out and check in (and afterwards out) for the remainder of your trip.

This answers my question.Thank you for your feedback - Where can I change my travel data or Work-Order number?

Log on at MijnNS Zakelijk. Work-Order number can be added under Kenmerk aan reis toevoegen - Managen reishistorie. Travel data is visible two days after the trip. A Work-Order number can be added afterwards when you traveled with check-in/out. If you travel by department card, you need to contact your cardholder.

This answers my question.Thank you for your feedback

Card administration

My destination is not reachable by public transport

If travelling by public transport is not possible or practical, your manager can grant you permission to travel by car. In that case, you will be entitled to a tax-exempt allowance of €0.23 per kilometre. If you travel with one or more colleagues per car, only the person whose car is being used has the right to this reimbursement.

International business travel

UT stimulates travelling by train for destinations within Europe. To help you select the best mode of travel for your destination, UT has developed the Train Map: a map that shows the cities that members of UT’s community regularly travel to. These cities are divided into three categories: cities where UT considers the train the default mode of travel, cities where the train is recommended and cities where the train is considered a challenging option.

international train travel

With a personalized NS business card, you can access your “Mijn NS zakelijk” (business) portal. If 'Book international travel' is visible under Immediate Booking in “Mijn NS Zakelijk”, then you can book an international train ticket using your NS-Business Card. If that is not the case, then you must first have this option activated by your faculty’s or department’s NS contact person.

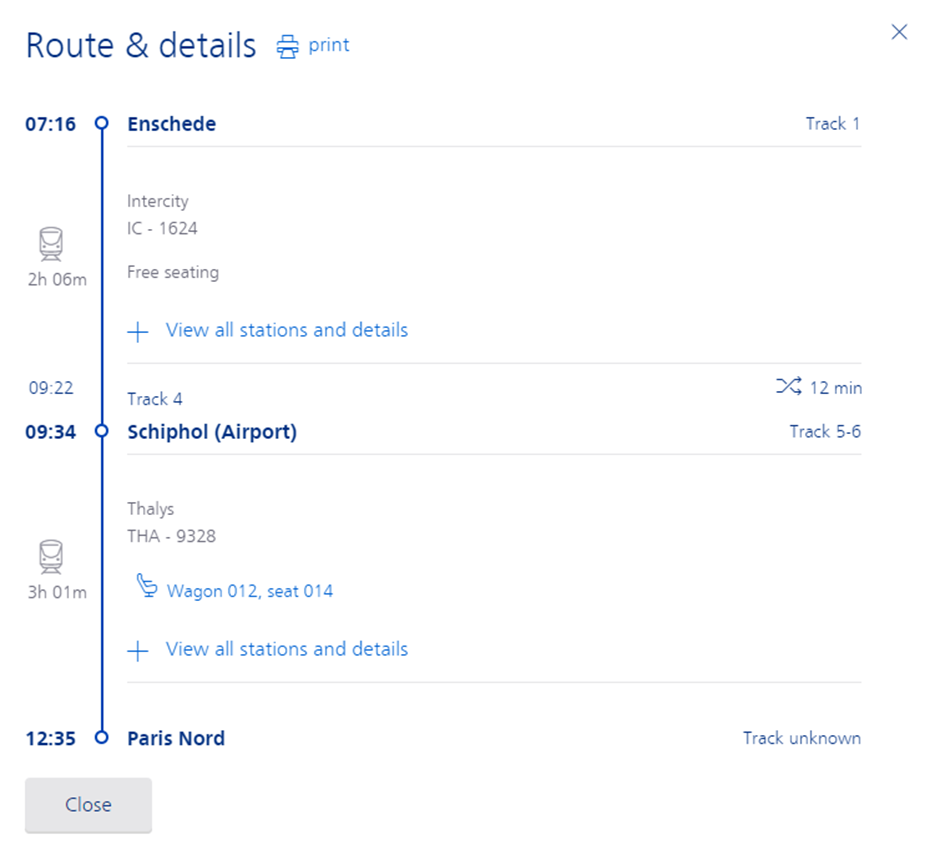

- How to book an international train ticket

Log in via Mijn NS zakelijk (choose log in as contact person) or via NS international (and log in via button top right)

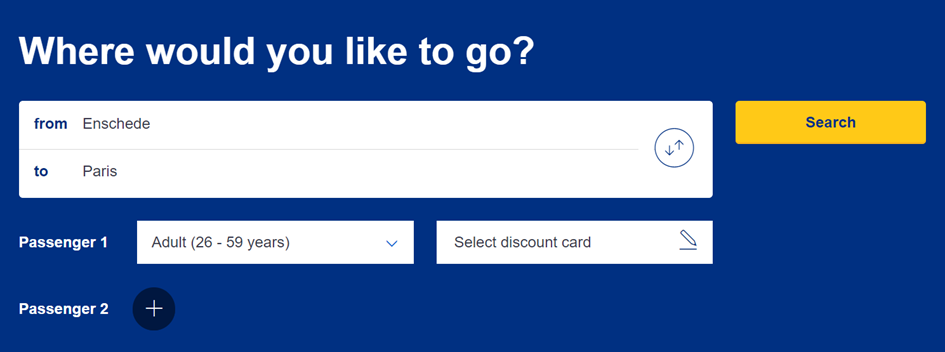

1. Choose your destination

2. Choose the day of travel (outward trip), followed by choosing departure time in the morning, afternoon or evening.

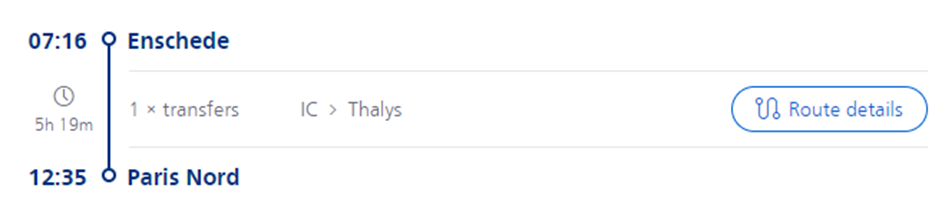

Example:

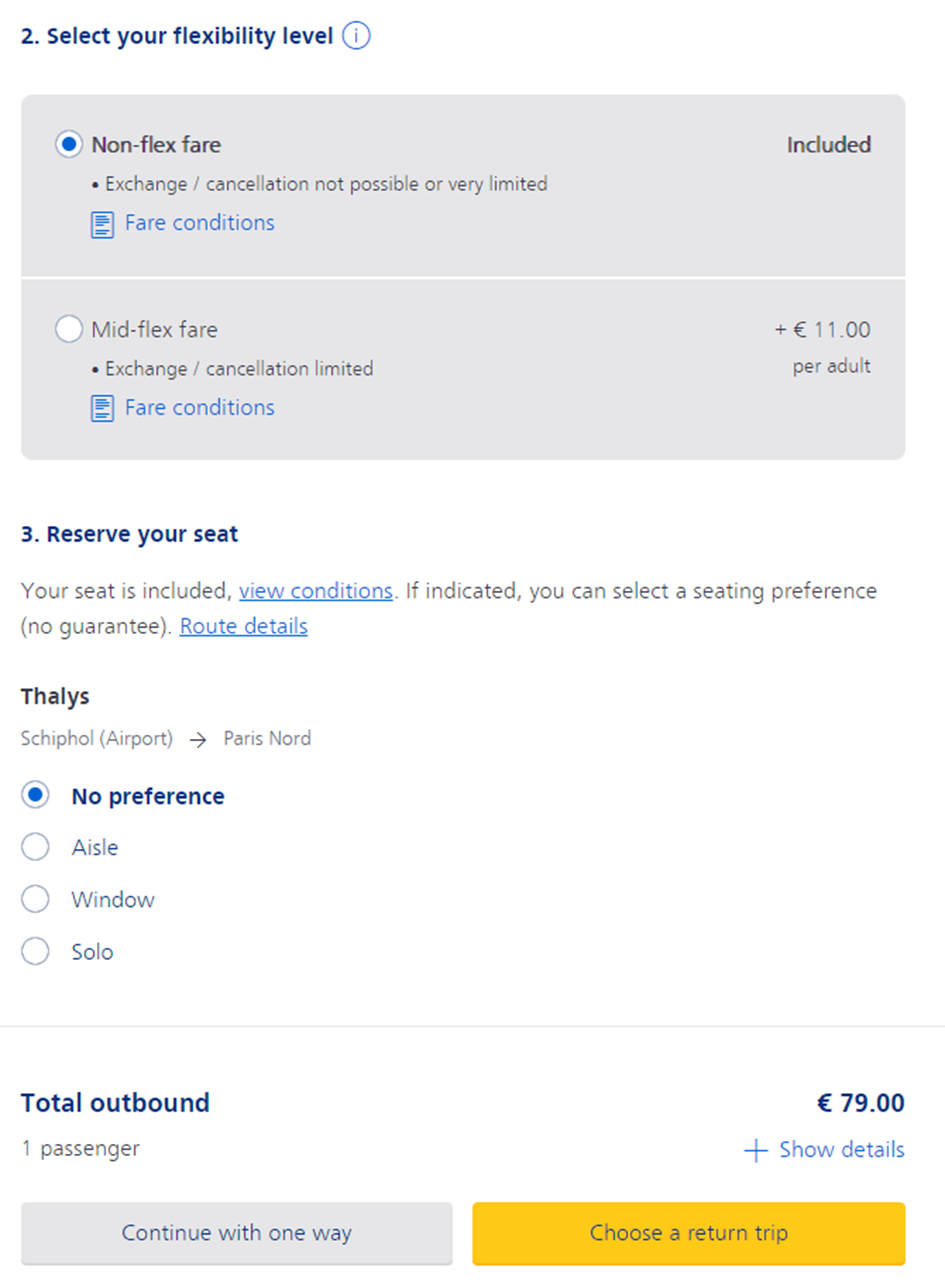

3. Choose travel class

4. Choose flexibility level and seat reservation

5. Then choose either continue with one way or choose your return trip and repeat the choices made above.

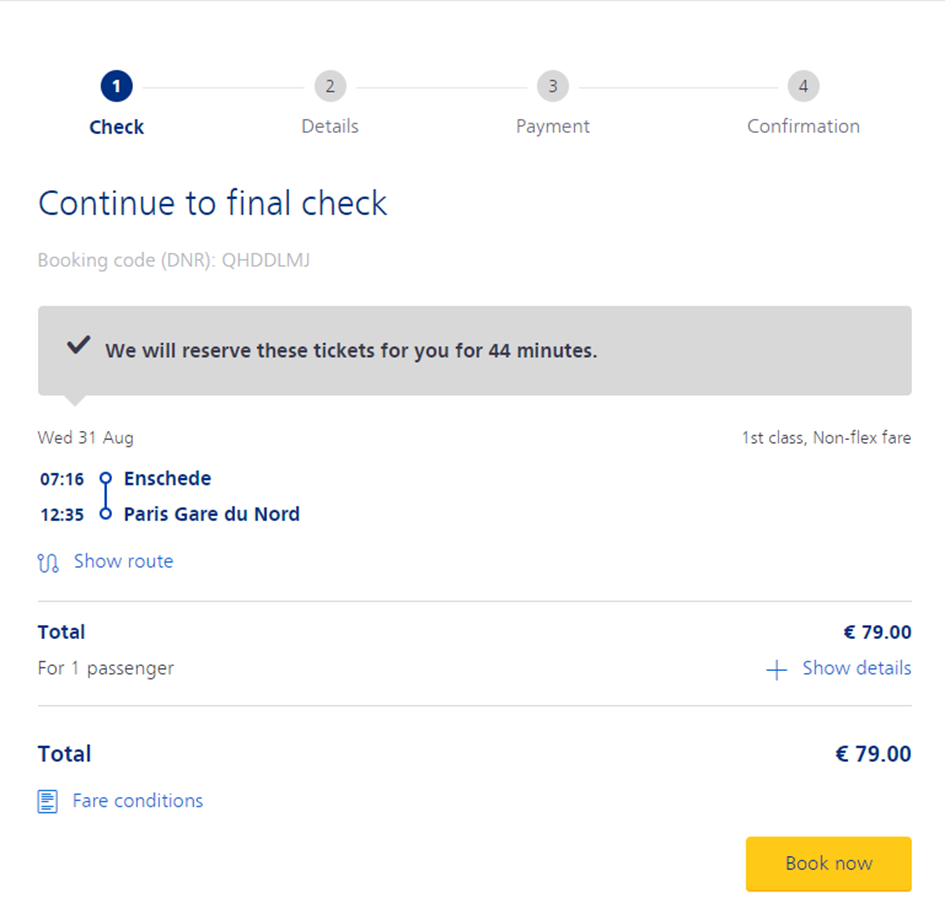

6. Click Book now to finalise the booking process.

You can see the route details and locations where you need to change trains.

Chat function NS

NS also has a chat function on this page, in case you need some help.

During an international journey, you only need your international train ticket to ride the train (digital or on paper). You only need to show your NS-Business Card if you are using the card to receive a discount on your international journey and/or while traveling to the departure station for your international train.

Please note: Always check your booking a day before you travel in case changes have occurred. - What about the domestic leg of my train trip?

When you book your entire journey via Mijn NS Zakelijk, your international train ticket is also valid for the domestic leg of your trip to the departure station for your international train. You need not check in and out with your NS-Business Card.

If you have booked your international journey from the departure station of the international train, but you still need to travel to that destination within the Netherlands, then you must check in and out for the domestic leg of your journey using your NS-Business Card. You can then continue your journey on the international train using your international ticket.

NS recommends booking the entire journey via Mijn NS Zakelijk, so that you do not need to check in and out along the way.

- Changing or cancelling train tickets

Depending on the applicable terms and conditions, you may change or cancel the international train booking any time before your scheduled departure date. Simply call the NS International Service Centre at 030 - 2300023. They are standing by to help you 24 hours a day, 7 days a week.

UT’s Travel Unit may be able to assit you as well. - For how many people can I book online with my NS business card?

Bookings can be made online for a maximum of 5 to 9 people at the same time, depending on the destination. The costs come together on one invoice.

- Travelling in a group / group tickets (as of 10 people)

You can submit group travel (as of 10 people) via Groepsreizen NS International.

E-mail: groepsreizen@ns.nl / telephone number: 030-2950884

Following information is required:

- destination

- outbound date

- return date

- preferred times

- work order nr UT

- name and cardnumber of the NS-Business Card

- My journey cannot be booked online

Sometimes it occurs that NS International cannot offer a specific route. In that case you are allowed to book your train tickets elsewhere and declare the costs; you can use for example www.thetrainline.com/nl. You can contact the Travel Unit for advice.

International flights

Standard flights can be booked by your department secretariat through the University's contracted business travel agent. Flight tickets booked in any other way will not be reimbursed. The UT Travel Unit department books complex business trips, combined trips, group trips, specific destinations and can make changes to bookings. The UT’s Travel Unit (UTTU), located in the ITC faculty building, can assist employees.

My destination is not reachable by train or plane

If travelling by public transport is not possible or practical, your manager can grant you permission to travel by car. In that case, you will be entitled to a tax-exempt allowance of €0.23 per kilometre. If you travel with one or more colleagues per car, only the person whose car is being used has the right to this reimbursement.

- Group travel insurance

Are you going on a business trip abroad? Then register in time for the UT's group travel insurance. To do this, use the web application 'Travel Insurance Registration'. You can use this application to directly request/edit your travel insurance policy(ies). You can also find the web application on the service portal under 'webapps for employees'. If you have any questions about this insurance, please contact insurance-fin@utwente.nl.

- Working abroad for a longer period

If you work abroad for a longer period, this is not seen as a business trip, but as "employment abroad". In addition to registering for collective travel insurance, it is important that you arrange a number of matters, including in the field of social security and health insurance. The information is summed up on the the 'working abroad' page.

Practical matters travel expenses

If you have incurred expenses during a business trip and these expenses are eligible for reimbursement, you can submit an expense statement afterwards. Normally, reimbursement is given based on original invoices. If the dean or director believes that, considering the circumstances, you cannot be reasonably expected to submit proof, they may decide that a written statement of the expenses incurred suffices.

- Travel Expenses Claim

You can claim travel expenses up to six months upon return from a trip. After these six months, the right to receive an allowance for expenses incurred lapses. Travel and accommodation expenses incurred on business trips can be claimed through:

Proceed to Unit4 ERP application- Webapplication: myfin.utwente.nl

- Android/iOS app: UT Expenses.

- Advance mission expenses

If you expect to spend more than €200 on travel and accommodation, you can apply for an advance. Use Unit4 to request an advanced payment via the Expenses module. More information can be found at the Service portal Unit4 Expenses.

- Standard travel allowances

The UT uses a different reimbursement scheme for these countries in Africa, Asia, Central and South America and Eastern European countries (non-EU members). If you go on a business trip to one of these countries, you are entitled to a standard travel allowance for expenses incurred during the business trip. This reimbursement excludes expenses for overnight stay. The latter expenses will, just like with trips to all other countries, only be reimbursed upon submission of the original invoices.

The standard fee is made up of various components, which are listed below. To determine the amount of the standard reimbursement, we use the same amounts that are used in the Collective Labor Agreement for Central Government Staff (Appendix 6). Each component is expressed as a percentage of the amount for miscellaneous expenses included for that specific country in the appendix 6 of the CLA for central government staff: tarieflijst verblijfkosten buitenlandse dienstreizen (price list for accommodation and miscellaneous expenses incurred on foreign business trips) (only in Dutch).

Price list - Components

- Hourly component (small expenses): 1.5% of the amount for miscellaneous expenses for every hour of the business trip.

- Breakfast allowance: 12% of the amount for miscellaneous expenses for every period from 06:00 to 08:00 falling within the business trip.

- Lunch allowance: 20% of the amount for miscellaneous expenses for every period from 12:00 to 24:00 falling within the business trip.

- Dinner allowance: 32% of the amount for miscellaneous expenses for every period from 18:00 to 21:00 falling within the business trip.

Please note: It may be possible that standard travel allowance is not allowed for a specific trip because of subsidy regulations. In such case, the regular reimbursement scheme applies and the UT only reimburses the expenses you can prove to have incurred.

Contact

Please contact HR Services for any further questions. Tel 053 489 8011.

For ideas, comments or changes to this page, please email webteam-hr@utwente.nl