MyHR (AFAS) is the HR and payroll system used to manage personal job-related details

This is a platform where you can manage your personal details regarding your job, such as submitting a leave request or reporting sick leave. Here we outline the most important aspects to know your way around, for example: an instruction animation, FAQ and where to go for contact & support

In this roadmap you will find the improvement actions that UT will be carrying out in the coming period to optimise the MyHR AFAS. Always with a brief explanation, for whom it is intended and why it is a desired improvement.

AFAS Pocket app

Use the QR code below to download or open the AFAS Pocket App

Easy sick and recovery reporting, request leave quickly and easily.

All the most important HR matters, including your paychecks under your thumb.

Note: Use the key: ESFM8H to receive an activation code by email.

Instruction video

Watch the instruction video below and find out the most important aspects of MyHR (AFAS) briefly so that you will know your way around.

Frequently asked questions (FAQ)

INFORMATION FOR EMPLOYEES

- General and support

- How do I login?

Login to MyHR (AFAS Online) via the list of web applications on the Service Portal or directly via myhr.utwente.nl. Use your UT email address and password. Please note: we use Multi-Factor Authentication (MFA). Go to utwente.nl/lisa to find out more. (If you logged in to a different application using MFA earlier in the day, this extra authentication step is not required for MyHR.)

- Who should I ask if I have questions?

In order to provide support to everyone at the University, key users have been appointed for the faculties and services. Key users are your first stop for any questions, problems or feedback regarding MyHR. The key users are listed in the table below. In addition, you can go the MyHR homepage and send your question via 'Ask HR'.

Faculty/service

Key user

BMS

Marleen Blijleven

EEMCS

Anna Kleinherenbrink

ET

Randy Pegge

ITC

Ingid Vuurpijl

TNW

Suzanne Jurgens

Services

Christine Maas

HR Central

Danielle Luisman

- I have a question about authorisation. Who should I contact?

If you have questions about authorisation, it's best to contact the key user of your faculty/service.

- Declarations

- How and where do I submit a declaration?

MyHR (AFAS) gives you the option of submitting declarations for moving, travel expenses and temporary accommodation via the declarations portal. You can find this portal by going to 'MyHR > My Claims'. This portal also gives you the option of declaring overtime hours, and hours for on-call staff. Other declarations are filed via Finance and thus not declared via MyHR (AFAS).

- I submitted a declaration. Where can I find it now?

Outstanding and approved declarations may be found by going to 'MyHR > My Claims'. At the bottom of this page you will find an overview of your declarations.

- Optional Model for Employment conditions

For your questions about the optional model, we refer you to the serviceportal page Optional Model.

- Resignation

- How can I submit my resignation?

You will eventually have the option of submitting your resignation by going to MyHR > My File > My Contract > My Resignation. Please note: the dismissal procedure is more than simply submitting a request. For that reason, you must first make arrangements with your supervisor and the HR for your service or faculty before submitting your resignation.

- Personal details and personnel file

- How do I change my personal details?

You can change your personal details using the button MyHR > My File > View Personal Details.

- Where can I find my personnel dossier?

In the menu under the tab MyHR > My File > My Digital File you can find your personnel file.

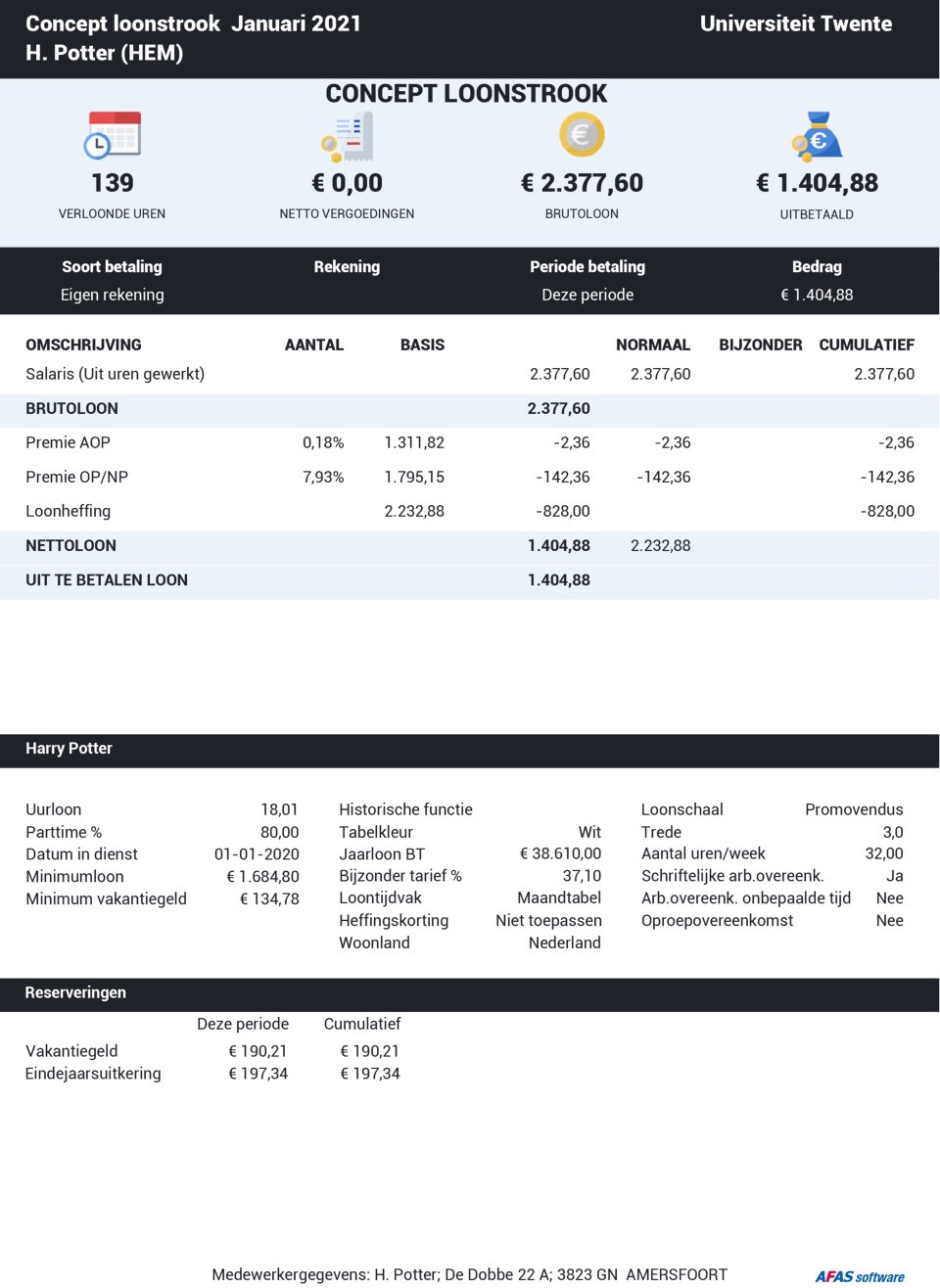

- Salary statement (salary slip) and annual salary statement

- When can I find my salary slip?

You can find your salary slip via MyHR > Visit My Payslips. On this page you can find more information about salary and payments.

- How to read my salary slip?

Please find below a clarification of the terms that are used on your salary slip:

Gross salary (dutch: brutoloon)

This is the amount the employee receives from the employer. This is the salary amount before deduction of the employee’s costs, however. Therefore, the gross amount is higher than the amount the employee will receive.

BSN

BSN is the abbreviation for burgerservicenummer (Citizen Service Number). This is a unique number given to every person who is registered in the Basisregistratie Personen (Personal Records Database). The government uses this number to process your personal information.

Annual salary BT (Dutch: Jaarloon BT)

This means the Special Rate (Bijzonder Tarief) that applies to the annual salary. It determines how much tax the employee has to pay on special allowances, which could include overtime, holiday allowance, etc. So, the higher the annual salary, the higher the tax. The percentage is set by the Dutch Tax & Customs Administration.

Payroll tax (Dutch: Loonheffing)

Payroll tax is the tax deducted from your salary by your employer on behalf of the Dutch Tax & Customs Administration. Payroll tax is the collective name for income tax and social security contributions. The amount of income tax is determined using the income tax tables. These tables are maintained by the Dutch Tax & Customs Administration.

Net salary (dutch: nettoloon)

This is the actual amount paid into the salary account as specified by the employee.

Net allowances (dutch: nettovergoedingen)

This shows the amounts the employee receives as net amounts in addition to the salary.

Part-time percentage

The part-time percentage indicates how many hours in percent you work for your employer. The employer sets the number of hours for a full-time working week, and therefore what your part-time percentage is if you do not have a full-time job.

Pension (dutch: pensioen)

The pension accrual is twofold. The employee and employer both contribute every month. The pension contribution you see on your pay slip is the employee’s part. This shows the percentage of the pension contribution and the amount used to calculate the pension contribution. The employer then ensures this amount is transferred to the relevant pension provider. The employee does not have to do this himself/herself.

Table colour

The table colour is either white or green. This colour determines which income tax table should be used to calculate the amount of the payroll tax. The white table is used when it relates to salary from current employment. The green table is used when it relates to salary from previous employment, such as a transition allowance for example.

Holiday allowance (dutch: vakantiegeld)

Once a year, the employee receives his/her accrued holiday allowance. Most employers pay the holiday allowance in May. This amount is accrued over the previous months.

Example salary slip (Dutch only)

- How can I access my salary slips and annual salary statements from before 2021?

Old salary slips and annual statements will first be accessible using the old application ‘Salary statements and annual statements’. You can also find the application via MyHR > Visit My Payslips.

- Leave

- How do I apply for leave?

You can find more information about applying for leave and general information about all sorts of leave on this page.

- How do I withdraw an application for leave?

As long as the start date of the leave you applied for has not yet passed, you can withdraw your leave application yourself. If the start date has passed, your supervisor has to approve this withdrawal.

- How do get my leave approved?

Leave applications for 120 hours or less are automatically approved. Leave applications for more than 120 hours will be presented to your supervisor for approval.

*The principle is that an employee who applies for leave has arranged this in advance within the unit.

- Absence

- How do I report an illness?

You can report your illness and recovery by going to MyHR or the AFAS Pocket App. Also contact your supervisor! For more information, check the serviceportal page Absence and Reintegration.

- I recovered from my sickness. How do I register this?

You can report your recover by going to MyHR or the AFAS Pocket App.

- Employer's statement

Go to MyHR > My File > My Salary and Benefits > Employer's Statement to request your employer's statement.

Information for managers

- Expiring contracts

- How can I arrange a contract extension for an employee?

As supervisor you will receive a task 90 days before the employee's contract expires. In this task you can indicate whether you want to extend the contract for a definite period, an indefinite period, or whether you want to let the contract expire. If you want to extend a contract, you also have to enter an end-date. After that, HR will take care of the extension.

- How do I report an employee leaving employment in AFAS?

As supervisor you will receive a task 90 days before the employee's contract expires. In this task you can indicate that you want to let the contract expire and thus report the employee will be leaving employment. If you want to dismiss an employee before this time, contact the HR for your faculty or service.

- Absences

For more information about Absences for managers check this serviceportal page.

TECHNICAL QUESTIONS

- General

- What is the difference between a task and signal?

A task requires an action (procedure) and a signal is a message you receive for information purposes.

- Where can I find all the requests (workflows) I've submitted?

You can find all your submitted tasks/workflows on the homepage. You can find this in the display under the heading ‘Submitted’.

- What should I do with a rejected request (workflow)?

When a submitted workflow is rejected it is put back in the 'Items' box on the homepage. You can then make changes or withdraw the request using ‘Modify’ or ‘Delete’ in the task itself.

- How can I have a task (request) withdrawn?

In order to withdraw a task, ask the approver of the task to reject it. You can also contact the key user of your faculty or service.

Contact

Please contact HR Services for any further questions. Tel 053 489 8011.

For ideas, comments or changes to this page, please email webteam-hr@utwente.nl