Several aspects play a role in the success of a university spin-off. One of those are uniform and transparent deal terms when it comes to Intellectual Property Rights and shares in the spin-off. That’s why the University of Twente uses the uniform deal terms below, which were formulated by a project team of the Dutch universities together with several investors and entrepreneurs and which were benchmarked (see below) against international best practices.

For more information about what this could mean for your specific situation, please contact Roy Kolkman, manager of our Knowledge Transfer Office.

spin-off Dealterms

1. Introduction

You want to use Intellectual Property Rights (IPR) for your spin-off. This may include patent rights, copyright on software, database rights, design rights or trade secrets that are fully or partly owned or contributed by the University. In this document you find the conditions at which access to these IPR may be granted.

As the Intellectual Property Rights that are owned by the University are (partly) funded with public money, and to comply with state-aid rules, the University has to enter into a market conform deal with the spin-off. That means the University will ask for either:

- a fully dilutive equity share;

- a license deal with royalty payment;

- a hybrid equity-royalty deal in exchange for providing access to the IPR.

The University (Holding) will decide (after consultation with the spin-off) which of the deal-templates (equity, royalty, hybrid) is applicable. In this document we’ll explain what these deal-templates entail.

Considerations

The basic principles that have been taken into account in the deal term principles are:

- Trust the founders that they are capable of making a success of the spin-off. This is measured by objective measurable milestones;

- The deal has to be market conform;

- Stimulate growth of the spin-off in favour of societal impact;

- Attractive for founders: sufficient reward to be committed to make a success of the spin-off;

- Optimized for follow-on investment;

- Transparency and consistency in deal terms.

The University or its affiliates might provide access to facilities or invest in the spin-off. This is not taken into account in the deal terms described in this document.

The deal terms are based on the importance of the IPR for the business case of the spin-off. Therefore, the amount of (public) money spent on the research leading to the IPR is not taken into account.

As the University strives to maximise impact of the IPR, the spin-off will be granted conditional access to the IPR based on objective, measurable milestones. If the spin-off proves successful, access to the IPR will be continued.

Input from investors and founders has been taken into account in the formulation of the deal terms.

Terminology

Equity

Access to IPR can be provided in exchange for equity (shares) in the spin-off company. The equity can be fully-dilutive, which means that when new shareholders (such as an investor) are added to the company, the share percentage of each shareholder proportionally decreases. Non-dilutive equity means that the percentage of shares that a shareholder holds does not change when new shareholders are added.

People often refer to the deals made by prominent US universities as being a ‘single-digit’ equity deal. It has to be noted that this equity is non-dilutive or only dilutive upon reaching a certain valuation of the spin-off company. Next to the equity, also an additional royalty agreement is often added to the deal. Most of the (European) investors that have been consulted prefer fully dilutive shares.

Founder Shares

The shares issued at the company’s incorporation to the founders are a reward for the future commitment of the founders and the risk they are taking by full-time (or part-time) quitting their current employment.

Inventors or creators of the IPR receive an incentive from the University for their contribution to the IPR. This is being paid from the proceeds received by the University (Holding) pursuant to the commercial exploitation of the IPR according to the regulations at the University.

2. General Terms

Applicable to equity, royalty and hybrid deals

- University will at all times be entitled to an automatic, non-exclusive, royalty-free worldwide perpetual, irrevocable license on any use of the IPR, but exclusively for educational and research purposes, including but not limited to research in national and European projects executed with public funding. The University will have the right to register this license in the Dutch patent register.

- Use of the IPR will be ‘As-Is’: University expressly disclaims any and all implied or express warranties and makes no express or implied warranties of merchantability or fitness for any particular purpose of the IPR or any information supplied by the University. Further, the University has not made an investigation and makes no representation that the IPR are free from liability for intellectual property right infringement.

- Follow-on IPR are not included. If the spin-off is interested in follow-on IPR, an agreement can be discussed at University’s discretion.

Time spent by University employees before the incorporation of the spin-off is part of the valorisation task of the University. After incorporation of the spin-off, the applicable rules of their institution on ancillary activities and participation in a spin-off will apply. - In case the spin-off needs University facilities (e.g. access to research labs), a separate agreement with the faculty/lab, on behalf of the University, can be discussed at University’s discretion.

3. Equity deal

The following equity-deal terms apply to situations in which:

- At least one scientific founder is committed to working full-time for the spin-off;

- The results from the research have a Technology Readiness Level (TRL) of a maximum of 4. The University (Holding) can deviate from the terms listed below for results at a higher TRL level.

If the University Holding is willing to become a shareholder in the spin-off to be established, it may offer an equity deal. With this deal, the University Holding receives an equity share in the spin-off in return for making the IPR available to the spin-off.

3.1 Shares

- The shares issued to the University Holding will be fully dilutive.

- The percentage of shares in the share capital of the spin-off requested by University Holding depends on how important the IPR is to the core unique value proposition of the business, the protectability and the potential for a lasting competitive advantage.

- The remaining shares will be for the current and/or future team members and are intended to build and reward the team that is able to reach the milestone(s).

- The milestone(s) are objectively measurable and reflect if the team has been successful in the early phase of the development of the spin-off: an investor has assessed the business case and is willing to invest a significant amount of venture capital, or the spin-off has shown to be successful by realising a certain amount of sales. Optional: the University (Holding) can add a technology milestone such as a certification. Therefore, the milestones will be:

- Cumulative Gross turnover amounting to at least 500 k€ OR Venture capital or other equity investment of at least 500 k€;

- (Optional) Technology milestone (e.g. certification).

- The University Holding will have common shares, but its share percentage will not be affected as a result of changes in and additions to the team until reaching the milestone(s), as the intended management has to build a team that is able to reach the milestone(s).

- Shareholders that remain (partly) employed by the University need explicit approval and have to comply with the applicable rules of their institution on ancillary activities and the maximum allowable share percentage (if applicable).

3.2 Access to IPR

- Until reaching the milestone(s) the spin-off is granted a free, exclusive, unrestricted user license – with the exclusion of the University itself – with the right to grant sublicenses on the IPR for a period of X years. The University will at all times be granted the license as described in section 2 (General terms).

- In case of IPR that is more broadly applicable than the business of the spin-off (Broad IPR), the license and/or its exclusivity may, to the discretion of the University, be limited to a specific field of use.

- In case the spin-off fails to meet the milestone(s) within X years, the spin-off will be granted a (continued) exclusive, a non-exclusive or no license to the IPR at University’s discretion.

3.3 Patents

- In case the IPR are concerning Patent Rights, the spin-off shall have a say on all aspects in respect of the application, maintenance and enforcement of the Patent Rights. That is, as long as the spin-off is granted an exclusive license to the IPR.

- In case the IPR are concerning Patent Rights, all out-of-pocket costs made by the University related to filing, maintenance and upholding of the Patent Rights for a period of maximum thirty (30) months from the initial filing date that are related to the priority filing and the subsequent PCT filing (Historical Costs) shall be reimbursed by the spin-off to the University upon completion of the milestone(s). Patent Right costs to be made after this period of thirty (30) months of the initial filing date as well as costs related to the national phases of the patent application, costs of transfer, and all costs after transfer shall be for the account of the spin-off.

- In case the spin-off has met the milestone(s) within X years, the spin-off proves to be successful in the early development phase. If and when the spin-off has met the milestone(s) within X years, and the patent (application) is not ‘Broad IPR’, the spin-off is granted the option to acquire the ownership of the patent (application) at payment of the Historical Costs. Depending on the policy of the University, the University might delay this option to the moment an exit occurs at the latest.

- University Holding may require that in the shareholders’ agreement and/or articles of association it is described that some far-reaching board and shareholders decisions[1] may need the prior approval of a qualified majority of the votes cast by the general meeting. This qualified majority may require a blocking vote for each shareholder until a bona fide professional investor steps in.

3.4 Share percentage

The percentage of shares in the share capital of the spin-off, requested by University Holding depends on how important the IPR is to the core unique value proposition of the business, the protectability, and the potential for a lasting competitive advantage. The share percentage relates to the attributes at the time of agreement, usually at incorporation. It will not be retroactively adjusted, for example, after pivots made possible by attracted resources based on the initial idea.

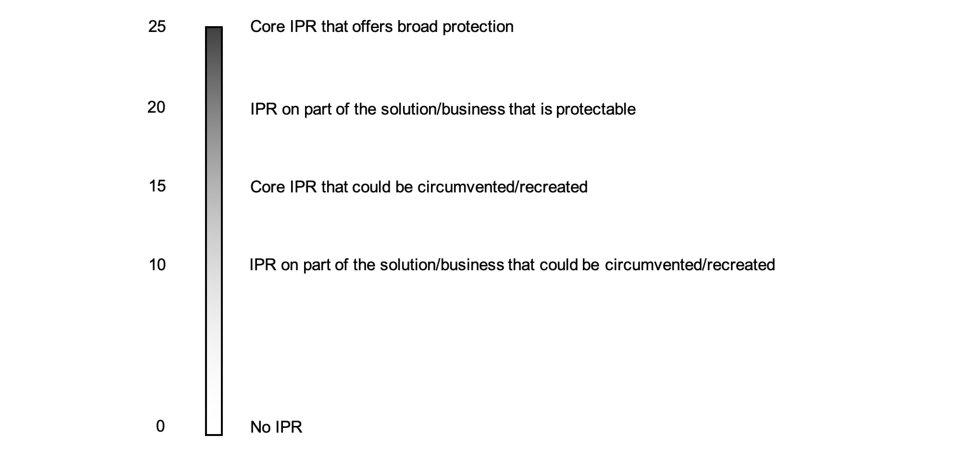

The following ruler will be the guideline for determining the amount of shares that University Holding will receive in return for providing access to the IPR.

3.5 Examples for further explanation

Core IPR that offers broad protection may be:

- A patent on an enabling technology that makes the solution and business proposition unique compared to the currently available solutions.

- Know-how on a unique, transferrable process to make a product, which has the potential to be kept secret and thus provides a lasting advantage.

IPR on part of a solution/business that is protectable may be:

- A patent that, in combination with IPR from other sources, creates a unique competitive advantage.

- A patent that only covers a single product while the business of the spin-off includes more products.

Core IPR that could be circumvented/recreated may be:

- Difficult or impossible to truly copy, it is an asset and provides the advantage of a head-start. Still, it has limited potential to provide a lasting advantage if competitors commit enough resources.

- Copyright on software, but with effort, could be inferred and rewritten based on what is observable to competitors.

- Databases owned by University that are not publicly available but could be recreated with effort.

- A design that is protected but with some changes may be at risk of being mimicked.

IPR on part of solution/business that could be circumvented/recreated

- See above, but requires a combination with IPR from other sources to create a unique competitive advantage or only covers a single product/service while the business of the spin-off includes more products/services.

4. Royalty deal

In case of a royalty deal, the University will receive a royalty payment on sales or other income related to products or services for which the use of the IPR is needed.

- Until reaching the milestone(s), the spin-off is granted an exclusive, unrestricted user license with the right to grant sublicenses on the Intellectual Property Rights (IPR) for a period of X years. In case of IPR that is more broadly applicable than the business of the spin-off (Broad IPR), the license and/or its exclusivity may, to the discretion of the University, be limited to a specific field of use.

- In case the spin-off has met the milestone(s) within X years, the spin-off proves to be successful in the early development phase of the spin-off and the exclusive license will be continued. In case the spin-off fails to fulfil any amounts due or fails to meet the milestone(s) within X years, the exclusive license will be turned into a non-exclusive or no license to the IPR at University’s discretion.

- The milestone(s) will be:

- Cumulative Gross turnover amounting to at least 500k€ OR Venture capital or other equity investment of at least 500k€;

- (optional) Technology milestone (e.g. certification).

- In case the IPR are concerning Patent Rights:

- all out-of-pocket costs made by University related to filing, maintenance and upholding of the Patent Rights prior to concluding the royalty agreement (‘Historical Costs’) shall be reimbursed to the University by the spin-off. In case of a non-exclusive license limited to a specific field, these costs may be (retroactively) shared if other licenses are granted;

- all costs regarding maintenance and upholding of the Patent Rights are for the account of the spin-off. In case of a non-exclusive license limited to a specific field, these costs may be (retroactively) shared if other licenses are granted. If it’s exclusive only to certain geographies, costs related to territories outside these geographies will not be for the account of the spin-off;

- as long as the spin-off is granted an exclusive license to the IPR, the spin-off shall have a say in all aspects in respect of the application, maintenance and enforcement of the Patent Rights.

- The royalty payment for the exclusive license will consist of:

- A royalty as a percentage of sales and other income related to products or services for which the use of the IPR is needed;

- A (higher) royalty percentage on income from sublicenses;

- (optional – to the discretion of the University) A minimum annual royalty payment (of which the first payment is an up-front fee and will be due on closing the license agreement);

- (optional – to the discretion of the University) Milestone payments related to e.g. certification, commercial sales.

The royalty percentages are dependent on the market sector and will be based on international benchmarks.

- Apart from the above-mentioned payments and the payments related to the filing, maintenance and upholding of the patent rights, no other payments will be due.

- In case the spin-off makes an exit (e.g. is acquired by another firm or goes public) the spin-off will be offered the option to acquire the IPR in case the IPR is not Broad IPR. The spin-off will have the option to buy off the royalty obligations at conditions to be negotiated at the moment that the exit occurs, or the royalty obligations will remain in force.

- Each year the spin-off will share all necessary information with the University, so the University will be able to determine the amount of royalties due.

- The provisions of the MVL toolkit[2] will be taken into account when concluding a royalty deal.

5. Hybrid deal

In a hybrid deal, the equity terms and royalty terms are combined: e.g. half of the equity percentage plus half of a full-royalty deal. As the University Holding is receiving an equity stake, the conditions on minimum royalty payment can be offered on more favourable terms to the spin-off compared to a full royalty deal.

[1] These decisions include, e.g. Issuance of shares, exclusion or limitation of the pre-emptive right upon issuance of shares, a delegation of issuance of shares, reduction of issued capital, amendment of the articles of association, winding-up of the company, drag along right, to acquire, alienate, encumber and otherwise acquire or make available the use or enjoyment of the Intellectual Property Rights, the establishment or amendment of an employee participation plan.

[2] “Maatschappelijk Verantwoord Licenseren (MVL) toolkit: https://www.nfu.nl/sites/default/files/2020-10/MVL_Toolkit_2020_NFU_VSNU.pdf

Founder experience

As a precursor to the new agreements, the University of Twente has already applied the new deal terms at the end of 2022 when founding several spin-offs, such as ReCarbn and Aluvia Photonics. In December, ReCarbn was founded with Guus Dubbink as CEO: "If you made the choice to found a BV as a researcher, there's a lot to consider and arrange. And most of it, you've never done before. Negotiation of the shareholders' structure seems the most challenging of these unknowns because the result has long-lasting consequences (until the end of the entrepreneurial journey). For ReCarbn, it helped tremendously that the University of Twente could provide a clear and transparent term sheet."

Benchmark

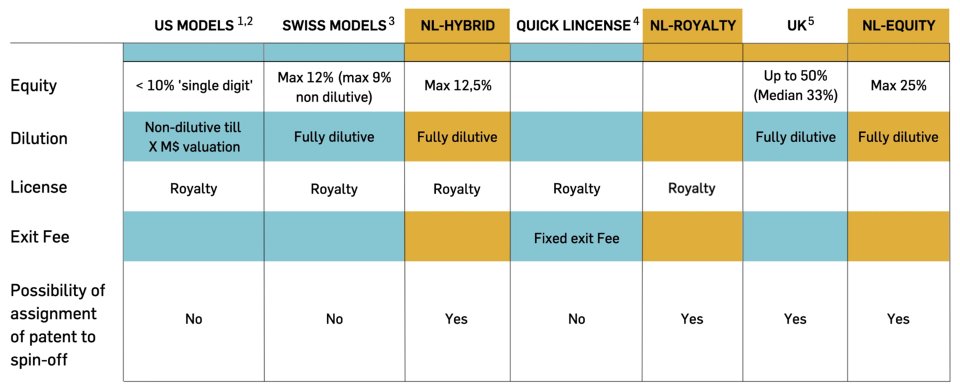

There are a large variety of terms that can be used in the dealmaking between a University and a spin-off. This makes a comparison between deals difficult, as all terms and conditions have to be taken into account and not only a single element. In discussions around deal terms, people often refer to US models1,2 where Universities are taking ‘single digit equity’ in exchange of IP. Another common referral to Universities’ best practices are the use of ‘quick licenses’3. A simplified overview of Universities that are considered to be using best practices for spin-off deal terms, is visualized in the table below. This data is based on publicly available sources (dated February 2023).

The NL-Hybrid model is much like the Swiss model4. After a first investment round, the equity percentage of the NL-hybrid model decreases in most cases to ‘Single digit’ equity and becomes comparable to the US models. The NL-royalty model is comparable to the quick-license model.

In UK an equity-only model is often being used with a median equity percentage of 33%5. The NL-Equity model is maximized at 25%. Compared to the US models, the NL-equity starts with a higher share percentage but does not request additional royalty payment and the equity is fully dilutive. Considering that in most US models an antidilution provision is included, the NL-Equity model becomes comparable to the US models after a few investment rounds (which is common practice for deeptech startups), with the advantage of lacking additional royalty payments, alignment of interests, and being able to get full ownership of the IP after reaching a certain milestone.

References

- https://web.stanford.edu/group/OTL/documents/Templates/Exclusive_Equity_Agreement_with_Stanford_3-23-18.pdf

- https://otd.harvard.edu/uploads/Files/Sample_Basic_Patent_Rights_Exclusive_License_Agreement.pdf

- https://drive.google.com/file/d/1g-LyKnoxJW3nKL2Zdr7aRdmiWCtxjOw2/view

- Unitectra (Basel, Bern, Zurich), see e.g.: https://www.unibe.ch/unibe/portal/content/e152701/e322683/e1084391/e1143019/ul_guidelines_spin-off_en_ger.pdf

- Ulrichsen, T.C. Roupakia, Z. and Kelleher, L. (2022). Busting myths and moving forward: the reality of UK university approaches to taking equity in spinouts. Policy Evidence Unit for University Commercialisation technical report. University of Cambridge: Cambridge, UK: https://www.ifm.eng.cam.ac.uk/research/uci-policy-unit/uci-news/uci-report-on-university-approaches-to-spinout-equity/